The Important Guide to Getting Bid Bonds for Your Following Venture

The Important Guide to Getting Bid Bonds for Your Following Venture

Blog Article

The Duty of Quote Bonds in Competitive Bidding Procedures

By providing an economic assurance that prospective buyers will certainly satisfy their contractual responsibilities if chosen, quote bonds serve as a crucial device in minimizing the dangers associated with non-performance. Comprehending how proposal bonds operate and their effects for both task proprietors and prospective buyers is important for valuing their full effect on the bidding process landscape.

What Are Bid Bonds?

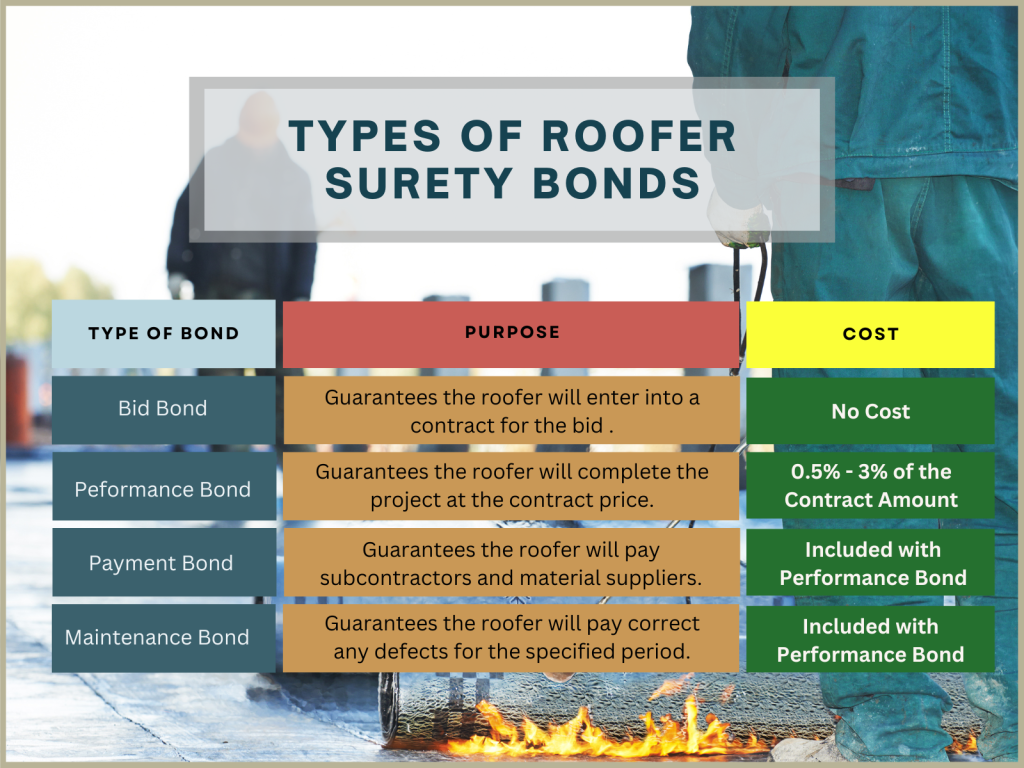

A bid bond is a kind of guaranty bond that acts as a financial assurance in between a task owner and a bidder. It makes sure that the prospective buyer will enter right into the agreement at the proposal cost and offer the needed efficiency and repayment bonds if awarded the agreement. Quote bonds are frequently utilized in construction jobs, where they serve to prequalify professionals and guarantee the severity and financial capability of the bidding process entity.

At its core, a bid bond provides protection to the project proprietor by minimizing threats associated with the bidding process. If a bidder, after winning the agreement, stops working to commence the project as per the bid terms, the job owner can assert payment up to the bond's value. This countervailing system covers the added expenses sustained by the owner to award the agreement to the next cheapest prospective buyer or to reinitiate the bidding process.

Fundamentally, bid bonds cultivate an equal opportunity in affordable bidding atmospheres, making certain that only monetarily steady and major bidders participate. They also add to the total honesty and performance of the purchase process, giving a layer of security and trust in between job proprietors and service providers.

Exactly How Bid Bonds Work

Understanding the auto mechanics of bid bonds is essential for stakeholders in the building and construction industry. A proposal bond is a sort of guaranty bond issued by a guaranty company, making certain that the bidder will certainly honor the terms of their proposal if granted the contract. It functions as a financial warranty to the job proprietor that the prospective buyer has the economic capability and intent to carry out the job at the recommended quote rate.

To obtain a proposal bond, a contractor needs to put on a guaranty business, supplying financial declarations, credit history, and information concerning the project. The guaranty firm then examines the threat related to issuing the bond. Upon approval, the guaranty concerns the bond to the contractor, who submits it together with their quote proposition.

Benefits for Project Proprietors

Supplying considerable benefits, bid bonds give considerable advantages for job owners in affordable bidding procedures. Mostly, they act as an economic guarantee that the selected service provider will enter into the contract at the bid rate and furnish the called for efficiency and repayment bonds. This guarantee mitigates the risk of the selected bidder backing out, thus stopping hold-ups and additional expenses originating from re-tendering the task.

Additionally, quote bonds advertise fairness and openness within the affordable bidding process landscape. By necessitating a bond from all prospective buyers, project owners can keep a fair playing field, inhibiting frivolous quotes and cultivating a professional bidding process setting. This ultimately results in the option of the most skilled and economically audio service provider, optimizing the project's result and guarding the proprietor's investment.

Requirements for Bidders

To join affordable bidding process procedures, prospective buyers must meet a number of rigid needs made to guarantee their capacity and reliability. Prospective buyers are generally needed to supply a quote bond, which offers as a monetary assurance that the bidder will enter right into a contract if awarded the project and subsequently furnish the needed efficiency and settlement bonds. This bid bond guarantees task owners that the bidder has a severe dedication to the job.

Additionally, bidders should show their economic stability and capacity to embark on the job. This commonly involves submitting audited financial statements, financial referrals, and credit scores. Such paperwork helps task proprietors evaluate the bidder's capability to finance the task and manage potential economic stress.

Experience and technological proficiency are additionally crucial. Bidders need to offer proof of past jobs of similar extent and complexity, usually with comprehensive task portfolios and customer references. This showcases their expertise and dependability in delivering high-quality job.

Typical Misunderstandings

One widespread false important source impression is that quote bonds guarantee the professional will win the task. In fact, a proposal bond just ensures that the specialist, if chosen, will certainly get in right into the agreement and give the needed performance and payment bonds.

One more typical misconception is the belief that bid bonds are unneeded for little or simple jobs. No matter job dimension, quote bonds offer as a protective action for job proprietors, making certain major and financially secure quotes. Missing this action can threaten the integrity of the bidding procedure and may invalidate a specialist from factor to consider.

Last but not least, some service providers presume that quote bonds are a monetary concern due to their expense. The cost of a quote bond is normally a small portion of the quote quantity and is a worthwhile investment for the possibility to secure a job.

Final Thought

These bonds guard task owners by decreasing the risk of unimportant proposals and enhancing the transparency and fairness of the bidding process. By imposing specific demands on bidders, bid bonds contribute to better project results and raised confidence in the option procedure.

A proposal bond is a type of guaranty bond that acts as a monetary guarantee between a project owner and a bidder. A quote bond is a kind of guaranty bond released by a surety company, guaranteeing that the bidder will certainly honor the terms of their bid if awarded the contract.If the specialist is granted the contract but stops working to enter into the arrangement or provide the necessary performance and payment bonds, the project go to this site proprietor can assert the bid bond. Bidders are usually called for to provide a quote bond, which offers as a financial warranty that the bidder will certainly enter right into an agreement if awarded the task and consequently furnish the needed performance and payment bonds. No matter of project size, bid bonds serve as a safety measure for task owners, making certain severe and monetarily steady bids.

Report this page